Target date fund calculator

Hypothetical Annual Rate of Return. Whether a target-date fund is a good choice for you depends on your investing style goals and risk tolerance.

Smartpath Retirement Funds Alliancebernstein

Ad Our Target Date Funds Are Built To Deliver Long-Term Performance For Your Participants.

. If you have a 401k plan you may already be invested in a. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. An investment in a Target Retirement Fund is not guaranteed.

Some 401 k plans use these funds as the default investment for plan participants who have not selected their. Designed To Help Participants Achieve Financial Well-Being To And Through Retirement. Enter custom date or.

What Is a Target Date Fund. Target date funds are often available through 401 k plans. Ad Explore funds and choose those that align with your clients goals.

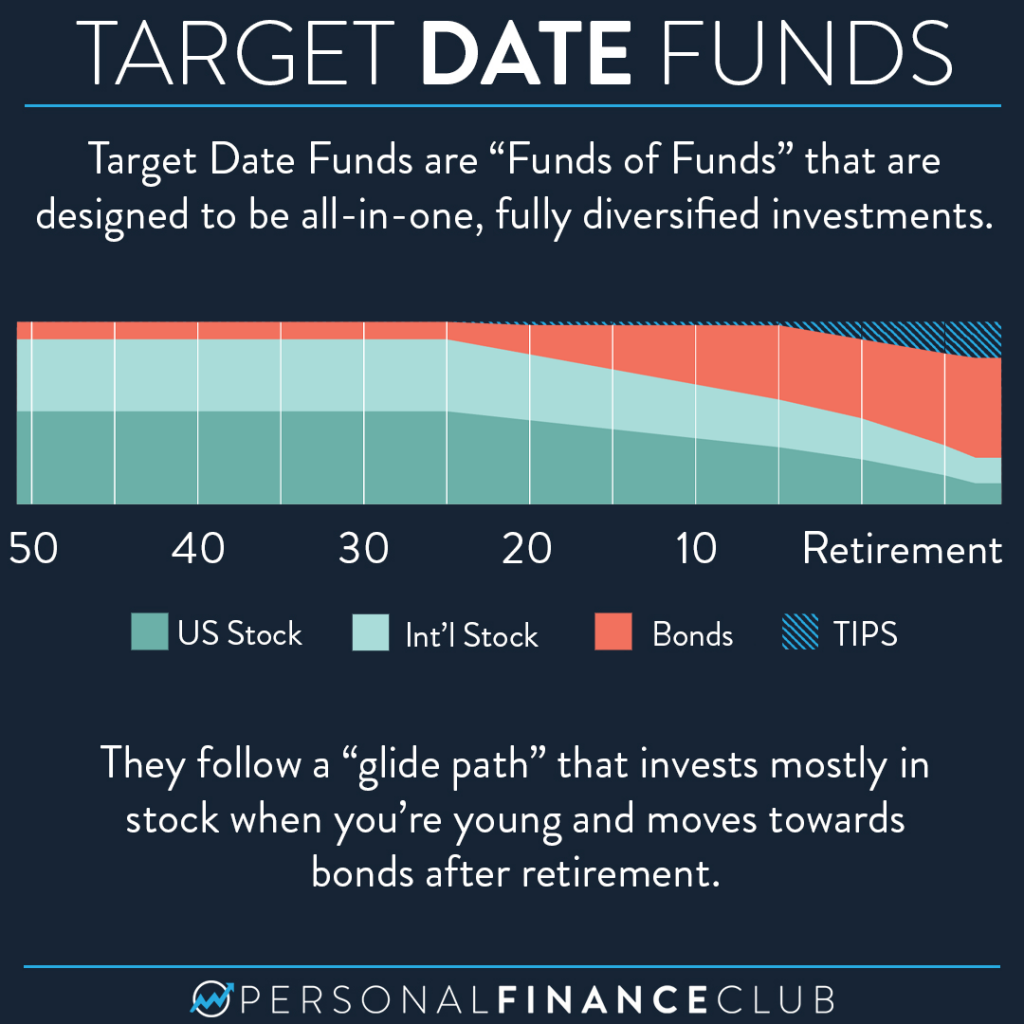

A diversified mutual fund that automatically shifts towards a more conservative mix of investments as it approaches a particular year in the future known as its. A target-date fund is a fund offered by an investment company that seeks to grow assets over a specified period of time for a targeted goal. A target date fund TDF is a.

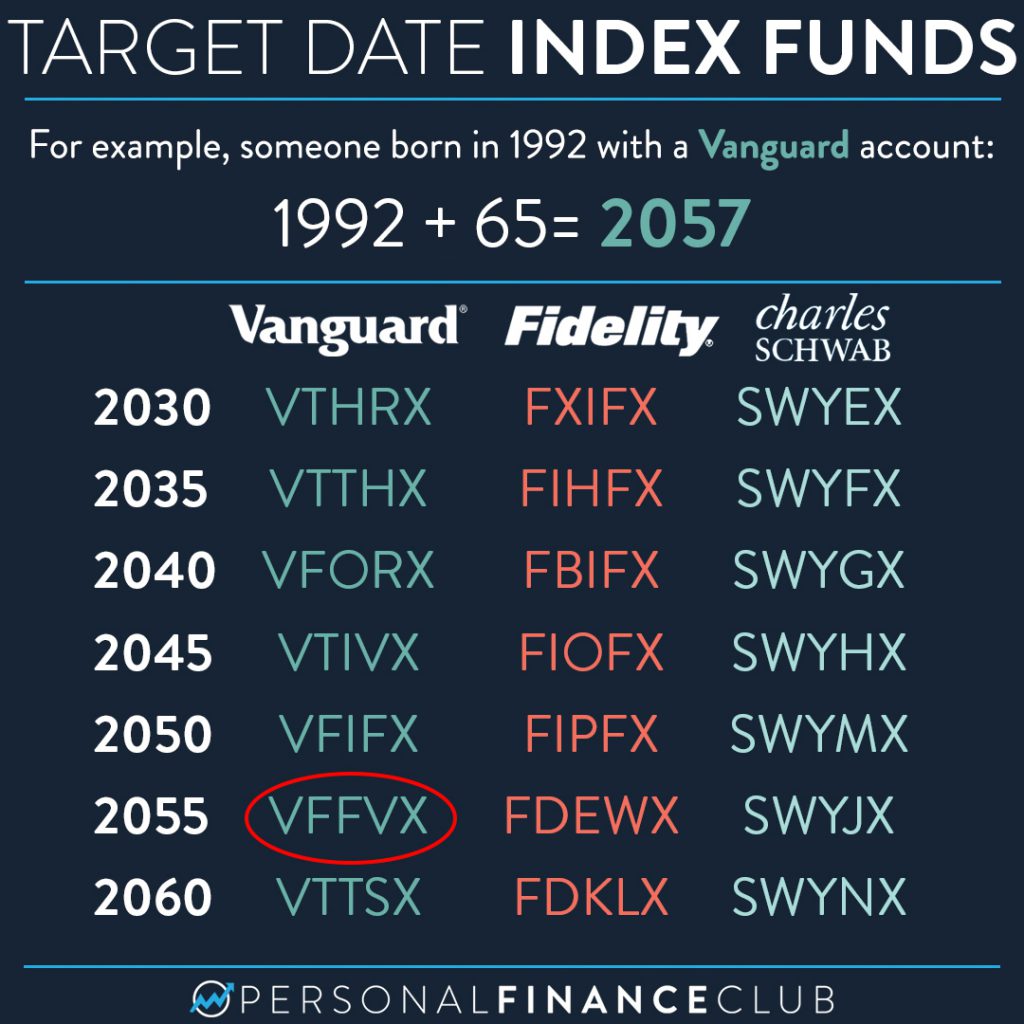

Target-date funds are designed to help manage investment risk. Most target-date funds are named in five-year increments so you would choose the provider with a fund named with the year nearest your planned retirement date. You can use this calculator to help you see where you stand in relation to your retirement goal and map out different paths to reach your target.

If youre wondering whether a target date fund might be the right choice for you here are some things to consider. Know Where You Stand and How to Move Toward Your Goals. You pick a fund with a target year that is closest to the year you anticipate retiring say a 2050 Fund The.

Know Where You Stand and How to Move Toward Your Goals. It is intended for use in making a rough. Ad Our Target Date Funds Are Built To Deliver Long-Term Performance For Your Participants.

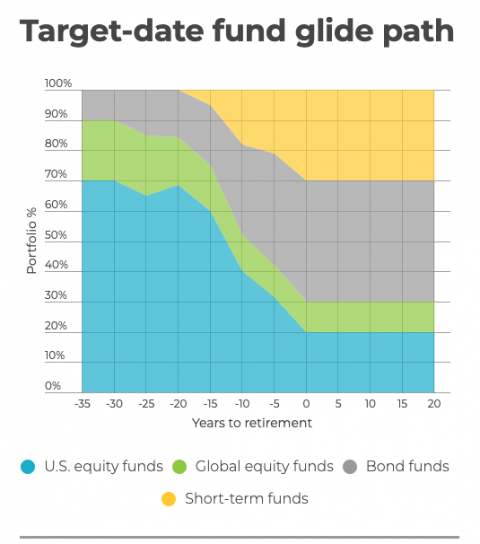

Ad Target date is the year savers may retire and determines portfolio asset allocation. Notice how the funds with a closer target date are invested less in stocks and more in bonds. Putnams target date glide path is designed to help participants be more successful.

Once the fund reaches its target date the allocation shifts to a 5050 portfolioso in the year 2060 this target date funds allocation will consist of 50 stocks and. The target date is the year that. Designed To Help Participants Achieve Financial Well-Being To And Through Retirement.

You can print the results for future reference. For instance a 2020 target date fund typically allocates between 40 and 50 in stocks. Our funds have star power.

The Pros of Target Date Funds. That means if a fund had a 7. Target Date Funds are designed to target a year in which an investor may withdraw funds for retirement or other purposes.

Target-date funds might make a lot of sense for an investor. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Target date funds have exploded in popularity.

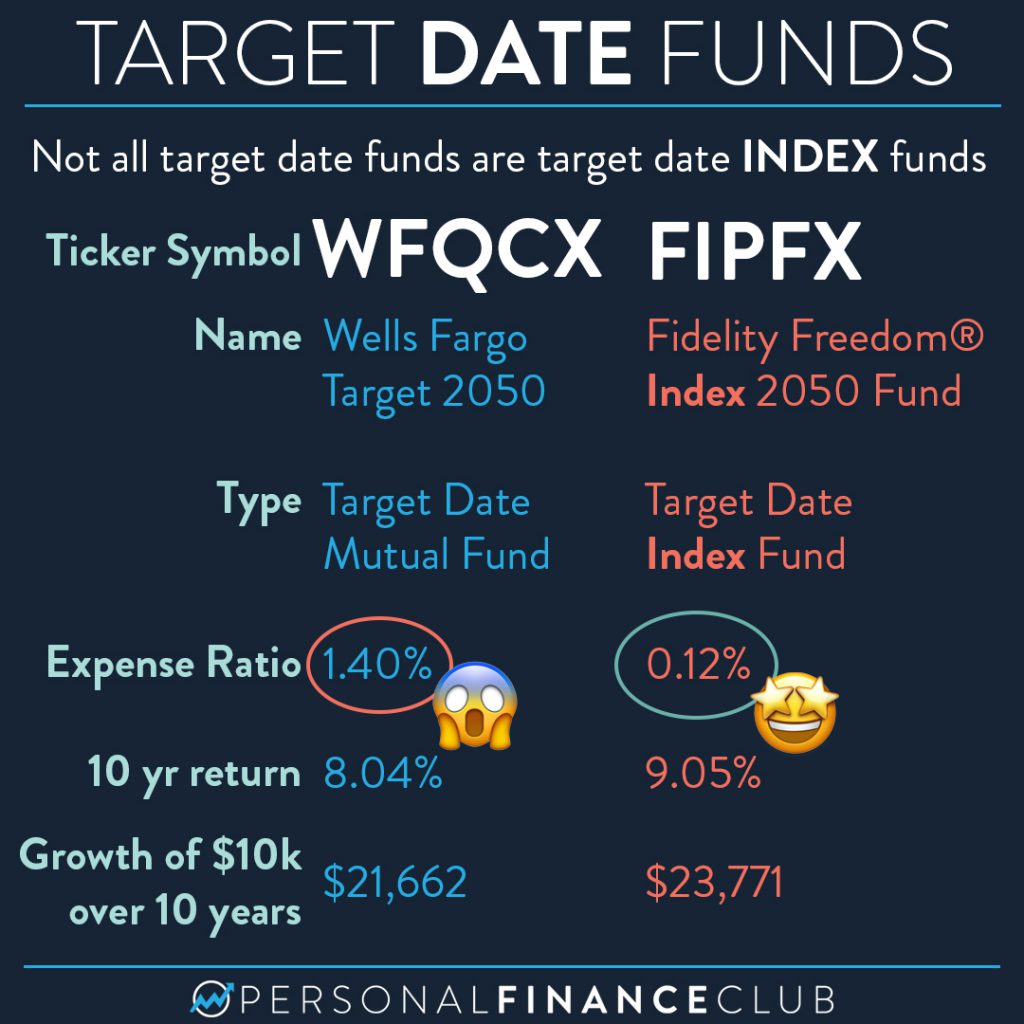

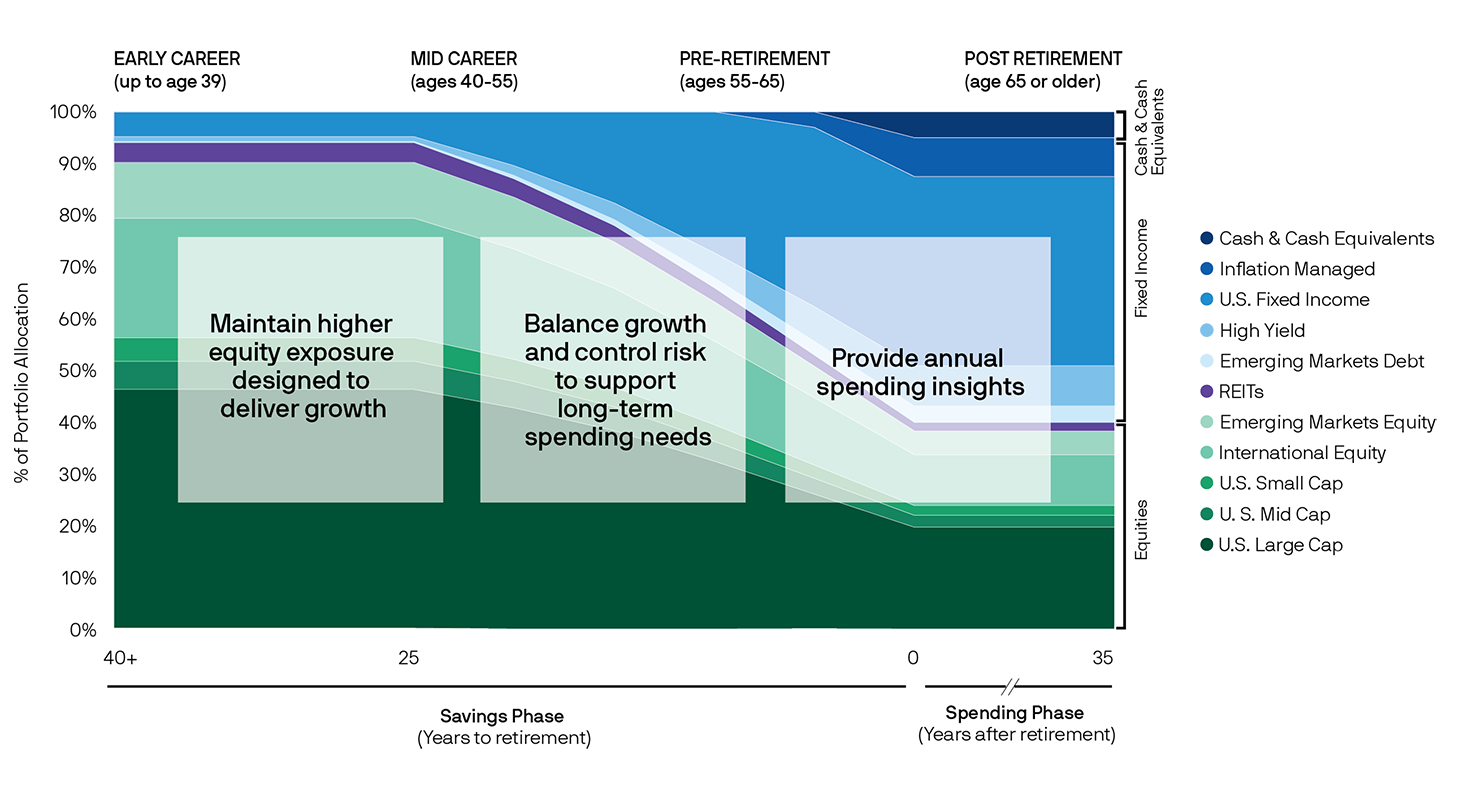

Morningstars recent survey of target date funds reports that the average asset-weighted target date fund expense ratio in 2020 was 052. Investments in target date funds are subject to the risks of their. Investment professionals manage the portfolio moving it from a more growth-oriented strategy to a more income-oriented focus as the target date gets closer.

This calculator was developed by KJE Computer Solutions which is not affiliated with American Funds. Read the Overview sheet which explains where youll find asset allocations where you can customize the target date and change the geographic allocations. A number of funds have earned 4- and 5-star ratings.

The fund will gradually shift its emphasis from more aggressive investments to more conservative ones based on its target date. Here are some real examples of target date fund options as of 2020. Target date funds make it easy for people looking to save for retirement to potentially maximize their future retirement income.

The Problem With Target Date Funds 529 Plan Case Study

Pin On Me

The Problem With Target Date Funds 529 Plan Case Study

Vfifx Vanguard Target Retirement 2050 Fund Vanguard Advisors

The Problem With Target Date Funds 529 Plan Case Study

The Problem With Target Date Funds 529 Plan Case Study

Seven Reasons To Put 100 Of Your Portfolio In A Target Date Index Fund Personal Finance Club

Seven Reasons To Put 100 Of Your Portfolio In A Target Date Index Fund Personal Finance Club

Seven Reasons To Put 100 Of Your Portfolio In A Target Date Index Fund Personal Finance Club

Voya Target Retirement 2045 Fund Voya Investment Management

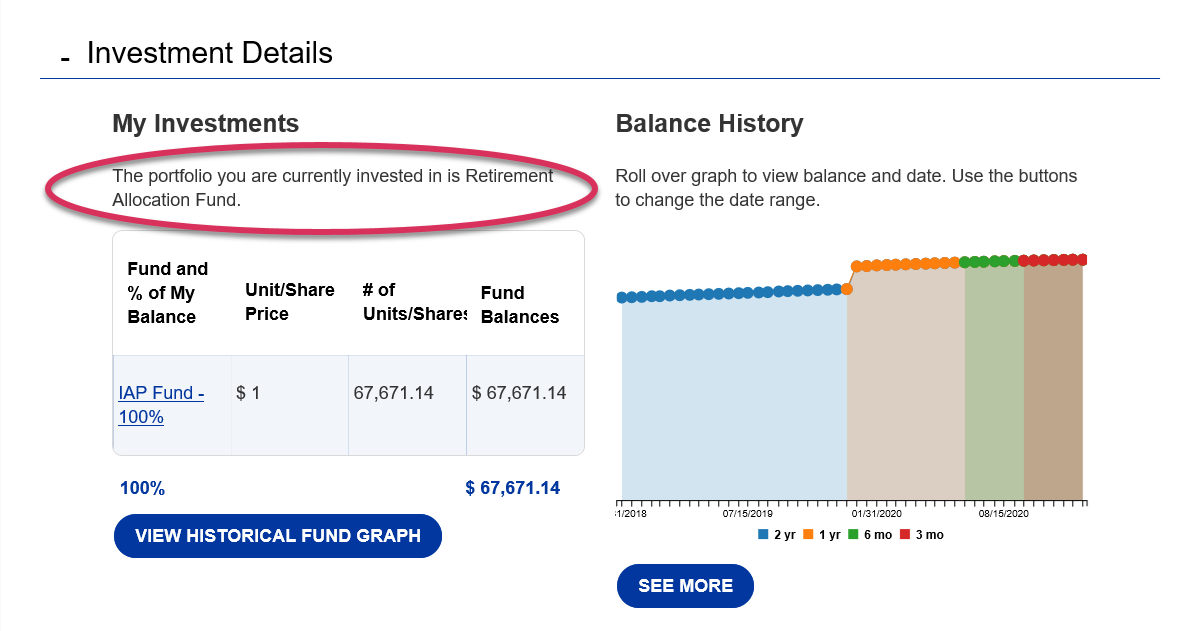

State Of Oregon Public Employees Retirement System Iap Target Date Funds

What Is A Target Date Fund And When Should You Invest In One Nerdwallet

Smartretirement Blend J P Morgan Asset Management

Seven Reasons To Put 100 Of Your Portfolio In A Target Date Index Fund Personal Finance Club

American Funds Target Date Funds American Funds

Self Employed Here Are 5 Retirement Savings Options For You The Motley Fool Saving For Retirement Investing For Retirement The Motley Fool

Pin On Social Media